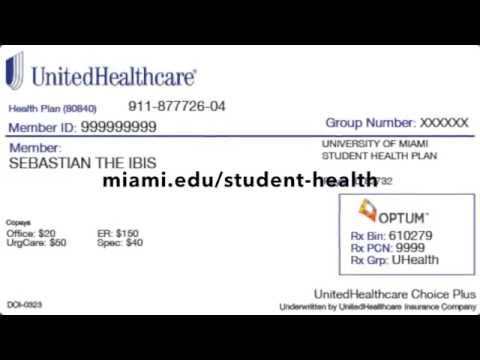

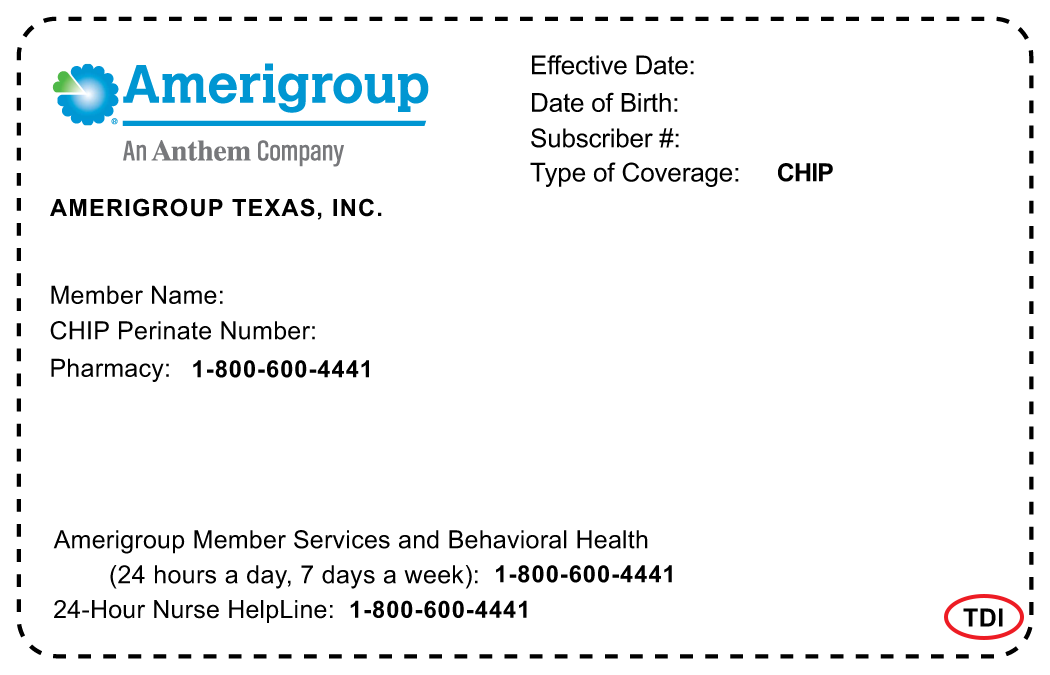

Please present your UHCSR student health insurance ID card each time you receive medical services to ensure proper eligibility verification and claims processing. Medical services include visits to physicians, hospitals, laboratories and other medical facilities, including the Student Health Center, as well as visits to mental health providers and pharmacy services. Please be sure that the provider includes your unique 7-digit StudentResources ID number printed on the front of your card when submitting claims or making inquiries regarding your eligibility.

You should point out to providers that ALL inquiries regarding coverage, copays and claims MUST be directed to UnitedHealthcare StudentResources , which is a stand-alone division of UHC. The UHCSR Customer Service toll-free number is listed on the front of your ID card and the claims mailing address is listed on the back of your ID card. Individual health insurance policies through UnitedHealthcare are more expensive than average; however, plans will most often come with added benefits and access to wellness programs.

Additionally, many customers have rated UHC well due to its supportive customer service department and smartphone app that can provide in-depth health analysis. UHC is the largest health insurance company by total policyholders. This is exemplified by the large suite of products that the provider offers, including health, dental, vision and disability. For the 80, 90 and 100 medical plans, you pay a $30 copay for physician office visits , when you use UHC network providers. Preventive care is covered at 100% with no deductible for in-network services.

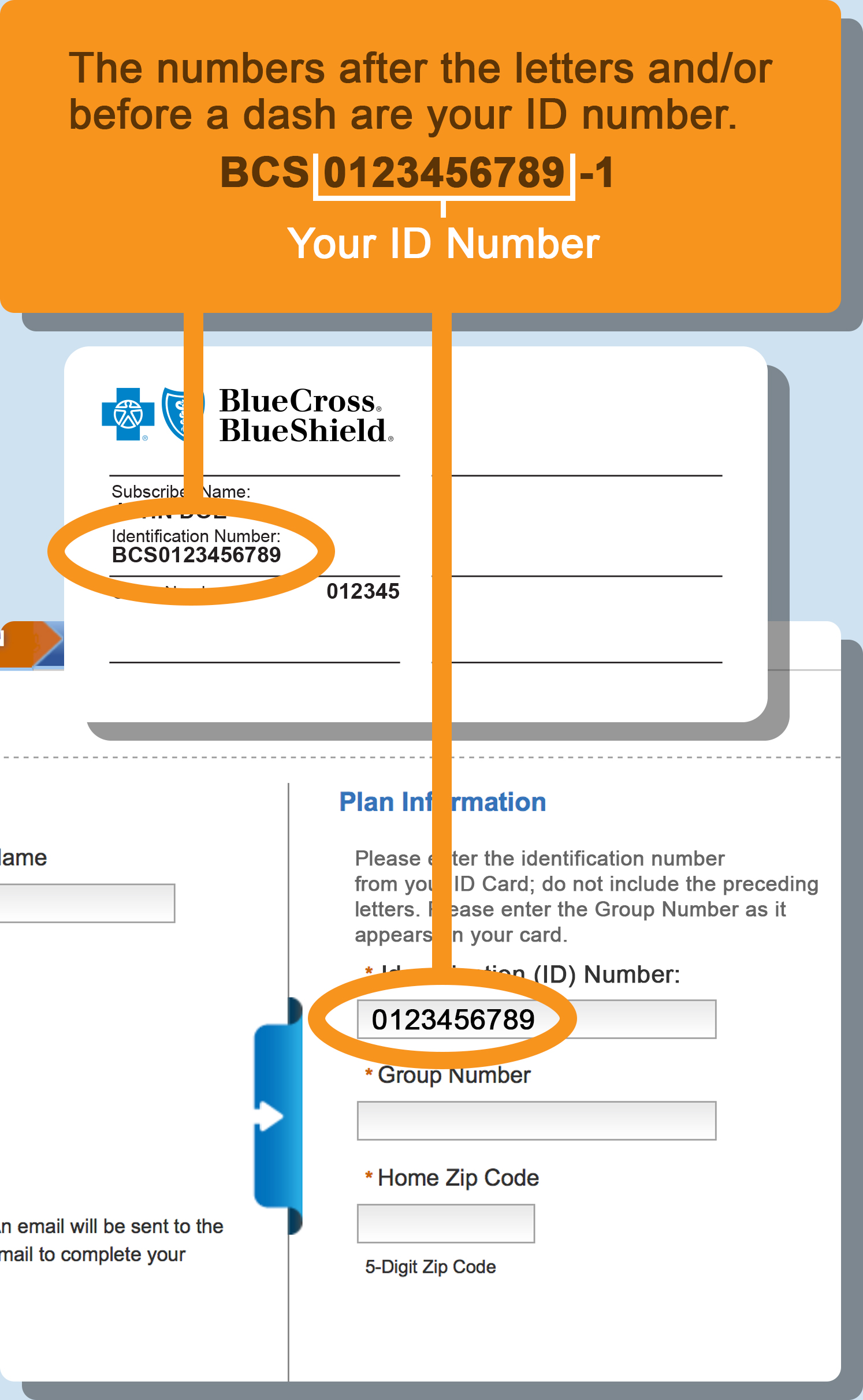

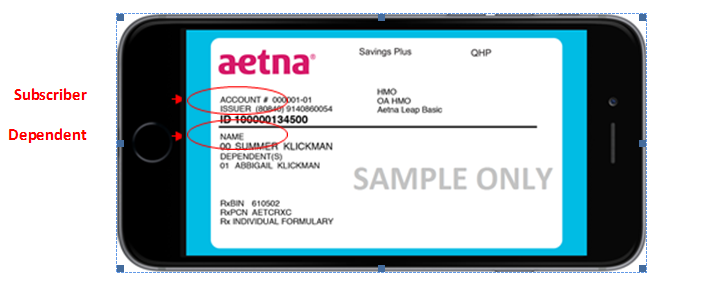

The deductible, coinsurance and all medical and prescription drug copays accumulate toward your annual out-of-pocket maximum. Each person covered by a health insurance plan has a unique ID number that allows healthcare providers and their staff to verify coverage and arrange payment for services. It's also the number health insurers use to look up specific members and answer questions about claims and benefits. If you're the policyholder, the last two digits in your number might be 00, while others on the policy might have numbers ending in 01, 02, etc. Many health insurance cards show the amount you will pay (your out-of-pocket costs) for common visits to your primary care physician , specialists, urgent care, and the emergency department. If you see two numbers, the first is your cost when you see an in-network provider, and the second—usually higher—is your cost when you see an out-of-network provider.

For example, when you're referred to a specific specialist or sent to a specific hospital, they may not be in your insurer's network. Finally, you might see a dollar amount, such as $10 or $25. This is usually the amount of your co-payment, or "co-pay." A co-pay is a set amount you pay for a certain type of care or medicine.

Some health insurance plans do not have co-pays, but many do. If you see several dollar amounts, they might be for different types of care, such as office visits, specialty care, urgent care, and emergency room care. If you see 2 different amounts, you might have different co-pays for doctors in your insurance company's network and outside the network.

UnitedHealthcare ranked seventh out of 10 insurance companies with a score of 795 points out of 1,000. A plan that provides coverage through a closed network of providers, not reasonably accessible to the student in the area where they attend school, for all but emergency services, does not qualify for a waiver. If you do not see your coverage amounts and co-pays on your health insurance card, call your insurance company . Ask what your coverage amounts and co-pays are, and find out if you have different amounts and co-pays for different doctors and other health care providers.

Please note that this is a division of UnitedHealthcare dedicated to student health insurance plans. The standard UnitedHealthcare online system commonly used by providers to confirm eligibility and coverage dates will not work for student health insurance plans. Out-of-network providers may not accept payment of students' cost share as payment in full and may therefore bill students for the difference between the amount billed and the amount paid by the plan.

If an emergency room facility or physician bills you for an amount above your cost share, you are not responsible for paying that amount. Please send the bill to the address listed on your member ID card and the insurance company will resolve any payment dispute with the provider over that amount. Students who do not have their own private coverage are automatically enrolled in the Student Health Insurance Plan, which is offered by United HealthCare. More information regarding this plan will be available soon.

Students who have coverage and opt out of the UAB SHIP must complete an online waiver through the Patient Portal. United Healthcare is a paperless company and does not automatically mail policy brochures and ID cards to members. Once the insurance company processes the enrollments, they will send an email to the student's ohio.edu address notifying them that the ID card is available. The email will provide insureds with directions to create an online account with the insurance company through their website. This is very easy to do, and requires insureds to simply choose a username and password. The online account allows students to print an ID card or upload a digital copy to a smartphone or tablet.

Online accounts cannot be created until the enrollment has been processed by the insurance company, and the insured has received their email from United Healthcare Student Resources. Your insurance company may provide out-of-area coverage through a different health care provider network. If so, the name of that network will likely be on your insurance card. This is the network you'll want to seek out if you need access to healthcare while you're away on vacation, or out of town on a business trip. A Summary of Benefits and Coverage is an easy-to-understand overview of a health plan's benefits and coverage.

The documents listed here apply to both medical plans, regardless of the provider network . In order for a mandated student to access the enrollment or waiver system form, the student must be included in the eligibility file that the University sends to United Healthcare Student Resources. To be included in the eligibility file, you must be registered for classes during the semester and the charge for mandatory health insurance must be assessed to your UGA Student Account. You can access the insurance company's system approximately 48 business hours after the charge is assessed to your UGA student account. UnitedHealthcare is the clear market leader in the Medicare market and offers a full assortment of Medicare insurance products. Though some costs may be higher with some UnitedHealthcare plans, the benefits are robust, and the network of healthcare providers is especially large.

Their online tools and user-friendly website, high-quality ratings, and unique partnership with AARP should offer consumers peace of mind. All of UnitedHealthcare's D-SNP plans include prescription drug coverage. In 2021, UnitedHealthcare removed copayments on covered drugs in most D-SNP plans.

UnitedHealthcare offers several types of Medicare Advantage plans, including HMO, HMO-POS, and PPO plans. Most UnitedHealthcare Medicare Advantage plans include extra benefits like dental, vision, hearing, fitness, and in-network telehealth visits. It also boasts the largest Medicare Advantage network of doctors, specialists, and other healthcare providers, though network size varies by market.

Approximately 10 to 12 days after accepting the coverage or choosing to enroll, you'll receive an email from UHCSR () at your university email address. This email provides a link to create your "My Account" and access your electronic health insurance card. A physical copy of your dental card will be automatically mailed to you, but a physical copy of the medical card will not be mailed to you.

You have the flexibility to use in-network or out-of-network providers each time you seek care. However, you can minimize your out-of-pocket expenses when you use in-network providers. Students should carry their health insurance identification card with them at all times because an unplanned emergency room visit can occur.

Providers always request a copy of your ID card when providing care, including emergency room providers. If you obtain treatment without your ID card a bill will be sent to you directly. If the bill is not paid within 30 days, many providers will send your name to a collection agency. If you present your ID card to the provider at the time of service, the bill is usually sent to the insurance company, first, for payment. UnitedHealthcare's Private Fee-for-Service plans have no provider network, which means members can get care from any doctor, hospital, or other healthcare providers so long as they participate with Medicare. UnitedHealthcare PFFS plans without prescription drug coverage can be paired with a Stand-Alone Prescription Drug Plan.

EHealth's Medicare website is operated by eHealthInsurance Services, Inc., a licensed health insurance agency doing business as eHealth. Contact may be made by an insurance agent/producer or insurance company. EHealth and Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This strip allows the provider's offices to run the card through a machine that will read and determine your coverage, co-pay and any authorizations you may need before the visit. You will also find three sections for separated for Member Information, Provider Information and Pharmacy Information.

Also will be the phone number for the corresponding sections above and the website for further information. The back of the card also houses the addresses the providers of care need to submit claims to for payment for medical services and pharmacy services. The "coverage amount" tells you how much of your treatment costs the insurance company will pay. This information might be on the front of your insurance card. It is usually listed by percent, such as 10 percent, 25 percent, or 50 percent.

For example, if you see 4 different percent amounts, they could be for office visits, specialty care, urgent care, and emergency room care. Out-of-network services are covered identically by each of the University's medical plans, and are subject to the out-of-network deductible and out-of-pocket maximum. You can use out-of-network providers for preventive services, subject to a separate deductible and coinsurance.

The descriptions below apply to most private health insurance ID cards in the United States. If you live outside the U.S. or have government-provided insurance, you may see some different fields on your card. A member ID number and group number allow healthcare providers to verify your coverage and file insurance claims for health care services. It also helps UnitedHealthcare advocates answer questions about benefits and claims. Even Medicare health plans with a national presence can vary locally in their cost, quality, and customer satisfaction.

We included the National Association of Insurance Commissioners' complaint index and AM Best's financial stability ratings. We also considered information from the companies on their programs and strategies. HMO-POS plans are like HMO plans but offer somewhat more flexibility to see healthcare providers outside of a specific network than HMO plans. Members in UnitedHealthcare's HMO-POS plans can get some covered services outside the HMO network, but out-of-network care costs more.

These plans require members to get all their care within the HMO network of providers. Students can voluntarily enroll in the Blue Cross Blue Shield Dental Blue plan. This coverage is NOT included with your student medical insurance plan; coverage is optional and purchased separately.

Students do not need to be enrolled in the medical insurance plan to purchase the dental plan. The cost is $528 for coverage form August 15, 2020 through August 14, 2021. To enroll, go to GallagherStudent.com/BC and select "Dental Enrollment Form" on the left navigation bar. The deadline to enroll is September 30, 2020 for fall and annual plans and February 28, 2021 for spring plans. Your health insurance company might pay for some or all the cost of prescription medicines. If so, you might see an Rx symbol on your health insurance card.

But not all cards have this symbol, even if your health insurance pays for prescriptions. Sometimes, the Rx symbol has dollar or percent amounts next to it, showing what you or your insurance company will pay for prescriptions. If you have health insurance through work, your insurance card probably has a group plan number. The insurance company uses this number to identify your employer's health insurance policy. When you get a health insurance policy, that policy has a number.

On your card, it is often marked "Policy ID" or "Policy #." The insurance company uses this number to keep track of your medical bills. Price is an important aspect to consider when choosing your health insurance policy. However, you should also look at the additional benefits that each health insurance provider offers.

For example, UnitedHealthcare gives policyholders access to wellness programs, which we evaluate in more depth in this review. The back of your member ID card includes contact information for providers and pharmacists to submit claims. It also includes the member website and health plan phone number, where you can check benefits, view claims, find a doctor, ask questions and more. Your member ID number and group number allow healthcare providers to verify your coverage and file claims for health care services. These numbers also help UnitedHealthcare advocates answer questions about your benefits and claims.

What Is Policy Number On Uhc Insurance Card The UAB Student Health Insurance Plan is provided by United HealthCare and offers the best available protection at a very competitive price. This plan includes preventive services and unlimited lifetime maximums for medical and prescription coverage. The SHIP is a 1-year commercial policy that is re-negotiated annually and designed specifically to meet the needs of UAB students. UnitedHealthcare also offers a UnitedHealthcare app where members can find and have video chats with in-network healthcare providers, view their claims and payments, get cost estimates, and refill prescriptions. You can chat with UnitedHealthcare representatives via Meta and Twitter seven days a week via direct message.

The back or bottom of your health insurance card usually has contact information for the insurance company, such as a phone number, address, and website. This information is important when you need to check your benefits or get other information. For example, you might need to call to check your benefits for a certain treatment, send a letter to your insurance company, or find information on the website. The main difference between these tiers will involve the premium, coinsurance and cost of a doctor visit. For example, the most expensive plan — Plus — provides the best after deductible coinsurance of 20%.

A short-term health insurance policy may be helpful if you are healthy and need minimum coverage, but this is a policy that should not be purchased if you have a family. Out-of-network/non- contracted providers are under no obligation to treat UnitedHealthcare plan members, except in emergency situations. Please call our customer service number or see your Evidence of Coverage for more information, including the cost- sharing that applies to out-of-network services. If you're looking for specific details about your prescription drug coverage, you maysign in to your health plan account. After you're signed in, go to pharmacy and prescription coverage to locate a network pharmacy. Prior authorization means getting approval before you can get access to medication or services.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.